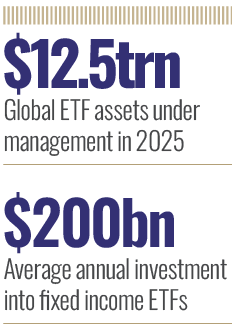

Exchange-traded funds (ETFs) have new heights to reach. That is the view of Blackrock’s Dhruv Nagrath – director of the firm’s iShares Fixed Income Strategy team – who said in August 2025 that the ETF market is both large and still in its early stages of growth. While there have been ups and downs over the last five years, $200bn a year has been invested in the fixed income industry despite the market volatility that has existed since the year 2000, and even though 2024 was a record year ($280bn).

In fact, Investment News reported that Nagrath revealed they had reached a record $12.5trn Assets Under Management (AUM) and declared that this was only scratching the surface to the extent that 2025 was expected to be yet another headline year. Miguel Ramos Fuentenebro, Co-founder of Fair Oaks Capital, also declared that from its own perspective growth is far from over.

Fuentenebro said, “In Collateralised Loan Obligations (CLOs), for example, ETF adoption is only at the very beginning in Europe: US CLO ETFs already represent over three percent of their market, whereas in Europe ETFs and UCITS funds together account for barely 0.2 percent of a €311bn CLO market.

“Investors are looking for floating-rate income and robust underlying assets and CLOs match that criteria. By providing those exposures in ETF format, we have democratised access into an asset class previously accessible only to the largest credit buyers,” Fuentenebro continued. The rate cut by the US Federal Reserve in September 2025 and the impact of market volatility caused by tariffs have nevertheless stirred up ETFs.

Subsequently, there has been an increase in trading volumes, and a shift from passive to active ETFs. This is because investors, with an eye on containing risk, are now drawn to diversified and fixed income solutions.

Market competitiveness

To encourage market growth, Vanguard has also slashed its fees on six equity ETFs that are domiciled in Europe by three and five basis points to counter fee pressure within core market segments. A fee drop may also be to respond to the fact that Blackrock leads the ETF haul, reports DL News, to the value of $3.5bn, while Vanguard currently sits in second place with $2.4bn. This may also be because Vanguard’s SPLG is 20 years old, while Blackrock’s IBIT started in January 2024.

As for Blackrock’s BINC – its iShares Flexible Income Active ETF – Seeking Alpha reports that it is seeing, “astounding growth in a decreasing rates environment.” The conclusion to that article by Binary Tree Analytics says: “The fund has seen a massive growth in AUM, with the assets now reaching an astounding $13bn figure. We like the risk-reward proposition here and the active management, and are of the opinion that BINC is a good choice for a macro environment where much lower Fed Funds are priced in.”

Speaking about ETFs, Hugh Morris, Senior Research Partner, Z/Yen remarks that ETFs are quite trendy at the moment. His company is seeing significant investor interest in ETFs and fixed-income ETFs. He therefore comments: “One strongly suspects that this has a fair way to go yet because there are a number of factors at play. I would say that, first, there has been interest from retail investors as ETFs are relatively simple to understand, and that combined with institutions’ desire for liquidity management and tactical asset allocation have produced a surge in demand.” He suggests this is against a background of market volatility, where fixed-income products look quite attractive because of their yield, and they provide a diversification option. On top of this, there are more trading platforms out there, and “the regulatory landscape has changed to make it easier to manage and launch ETFs and ETF markets also have greater transparency than previously,” Morris continued.

There are also niche ETFs targeting sectors in particular, such as green bonds and cryptocurrencies, Morris says before adding: “Combine all these trends together with a rise in actively managed fixed-income ETFs, then investors have more options than before.”

Growing interest in ETFs

As for the future, there is growing interest in fixed-income ETFs that focus on emerging market debt. Alongside this, he reports that there is huge growth in the corporate bond market for ETF offerings as ETFs can be used as a hedge against inflation. They can also function as a hedge against volatile interest rates too. As for CLO ETFs, Fuentenebro says they began in the US. Despite this, the same forces are at work globally. His company launched the first AAA CLO ETF in Europe 12 months ago. “The reception shows there is clear global demand – we have seen interest from European investors but also from investors in Latin America, the Middle East and Asia, often into the USD-hedged share class.” So, while he finds that the US is ahead in scale, he suggests that the global investor base is increasingly comfortable with ETF wrappers for specialist fixed income exposures.

Morris adds: “ETFs have lower management fees compared with mutual funds, and the structure of ETFs allows for tax-efficient trading. Looking into the future, there are lots of untapped segments – such as the corporate bond world and emerging markets debt.”

“You name it, you can do an ETF in it. While ETFs have been US and Western markets focused; there is increasing traction in Asia. It is for the same reasons – people have suddenly discovered them as they are easy to put together and launch,” Morris noted.

He therefore agrees that fixed-income ETFs are only just scratching the surface because they have shown, in his opinion, “great resilience.” This robustness is attracting investors’ interest. Fluctuating interest rates and concerns about inflation, he stresses, are making fixed-income ETFs attractive because they deliver yield. This trend is also driven by the levels of economic uncertainty. However, ETFs are also tax efficient, subject to favourable regulation, cost-efficiency and lower management fees, and they are easily and increasingly accessible via digital trading platforms.

So, what made 2024 a record year? Morris responds: “All of the things we have talked about really kicked in during 2024; a story that is still driving in 2025 and even into next year. It is all about ETF products becoming easier to buy and more regulated (allowing funds that couldn’t buy ETFs now being able to do so as a result of the changes in regulations), which means that institutions can use them for tactical asset allocation and liquidity management purposes.

“Part of investors’ portfolio management is the search for yield, which you get from fixed-income ETFs. They are going to continue to grow. It is slightly unusual to get retail and institutional interest combining to provide additive demand for an asset class, and that is a major factor affecting ETFs that I believe will continue into next year,” Morris added.

Rate hike shocks

As for rate hike shocks, and perhaps even reductions, he claims there are often immediate market reactions, which lead to market volatility. The impact is often short-term, and he finds that investors are getting used to them. However, there are two types of investors to consider. Morris says that they are the ones that “believe in the longer-term potential of ETFs who see the short-term shocks as being part of life’s rich pattern, and so short-term volatility doesn’t deter them from holding ETFs.” Then there are arbitrageurs for whom volatility is an opportunity; they will seek to take advantage of short-term movements.

The ETF market is both large and still in its early stages of growth

So why has $200bn a year been invested in the fixed-income ETF industry, despite market volatility since 2020? Fuentenebro responds from a AAA CLO ETFs perspective, declaring that the answer lies in the floating nature of the asset class. He claims these securities are far less exposed to the “sharp swings in government bond yields we saw around Liberation Day.” He adds that this ‘insulation,’ combined with the structural strength of AAA CLOs, has meant CLO ETFs offered investors differentiated exposure to fixed income.

Morris underlines that fixed-income ETFs provide risk mitigation. This is because they are a more stable investment option than bonds. “They provide diversification benefits, helping to manage exposure to bond markets, and when interest rates fall, they provide a source of income – our famous yield,” he explains. As they are liquid, they are easy to trade – coming with a lower cost of ownership in terms of management fees compared to mutual funds.

He adds: “There are new offerings out there, as well as active management ETF options now available. They don’t just affect young investors because older investors are looking for risk management and they are looking for income generation as they approach retirement. ETFs appeal to younger investors as they look exciting, and to older investors for the factors of risk management, income generation and lower fees.”

Fuentenebro says tax efficiency is not the main draw in Europe. Other factors include transparency, daily liquidity, and UCITS governance. However, he also comments: “It is also worth noting that, for European investors, US-domiciled ETFs are often less efficient due to both tax leakage and access constraints. By contrast, a UCITS ETF such as ours provides the right regulatory format, efficiency, and accessibility for European and global allocators.”

A bright future ahead

As for iBonds, Morris thinks they are an interesting concept – adding another dimension to the market. He therefore concludes that they will play their part in the ETF landscape, and so he’s “absolutely optimistic about fixed-income ETFs reaching new heights.”

In his view they will become a broader and deeper market, and he believes iBonds will be one of the instruments that will help ETFs provide an inflation hedge and predictable cashflows. While he won’t predict what will happen over the next five years, he assumes that volatility and economic uncertainty will remain, and so ETFs – particularly fixed-income ETFs – have a bright future ahead.