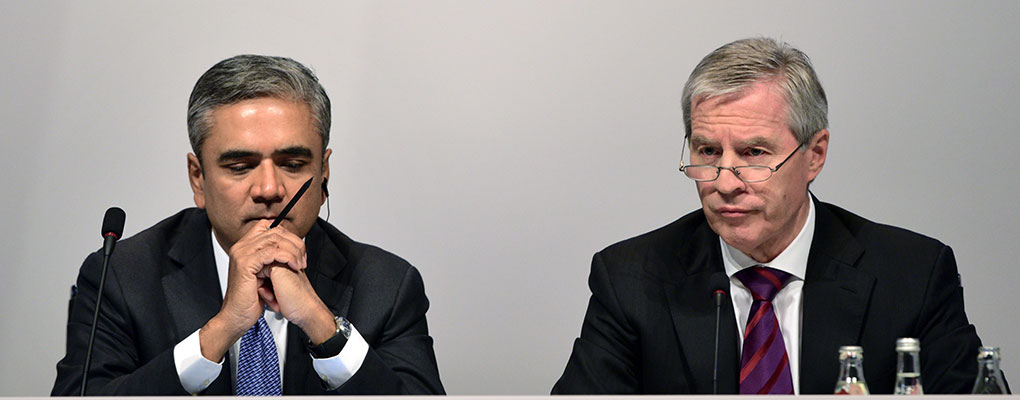

Deutsche Bank co-CEOs Anshu Jain and Jürgen Fitschen have tendered their resignations after the bank was hit with a series of fines recently, and in response to mounting shareholder discontent with the bank’s consistently below par profit growth. The supervisory board of Deutsche Bank has appointed Chairman of the Audit Committee and member of the Risk Committee, John Cryan, to the position of co-CEO, alongside Fitschen, effective July 1.

The bank is already pursuing an aggressive cost-cutting plan

“On behalf of the Supervisory Board, I would like to express our gratitude and respect for the contributions that Jürgen and Anshu have made to our bank,” said Paul Achleitner, Chairman of the Supervisory Board of Deutsche Bank in a statement. “Due to their decades of commitment, Deutsche Bank attained its leadership position. Their decision to step down early demonstrates impressively their attitude of putting the bank’s interests ahead of their own.”

Fitschen will stay in the co-chief role until the bank’s next Annual General Meeting is done next May, in order to protect against any transition pains.

The 54-year old former UBS CFO and President for Europe at Singaporean investment firm Temasek is an experienced investment banker, and, according to Achleitner, has “extensive experience in financial matters but also espouses the professional and personal values required to advance Deutsche Bank and Strategy 2020. He knows the bank well, and we are convinced that he is the right person at the right time. We wish John and all of our employees success in this important next phase for the bank.”

Deutsche Bank is currently the only European bank still on Wall Street, though a changed regulatory environment together with a $2.5bn fine issued recently, in relation to the bank’s part in the libor scandal, have done much to slow its progress. Its net income for the first quarter was half that of the same period a year previous, and analysts have been critical of the bank’s overreliance on borrowed money.

The bank is already pursuing an aggressive cost-cutting plan, in which it intends to save €3.5bn on an annual basis and boost profits as a percentage of capital invested. The incoming co-CEO said in a statement: “Our future will be defined by how well we deliver on strategy, impress clients and reduce complexity.”